Business Insurance in and around Granbury

Get your Granbury business covered, right here!

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a HVAC company, a window treatment store, a home improvement store, or other.

Get your Granbury business covered, right here!

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

Your business thrives off your commitment tenacity, and having great coverage with State Farm. While you support your customers and lead your employees, let State Farm do their part in supporting you with artisan and service contractors policies, business owners policies and commercial auto policies.

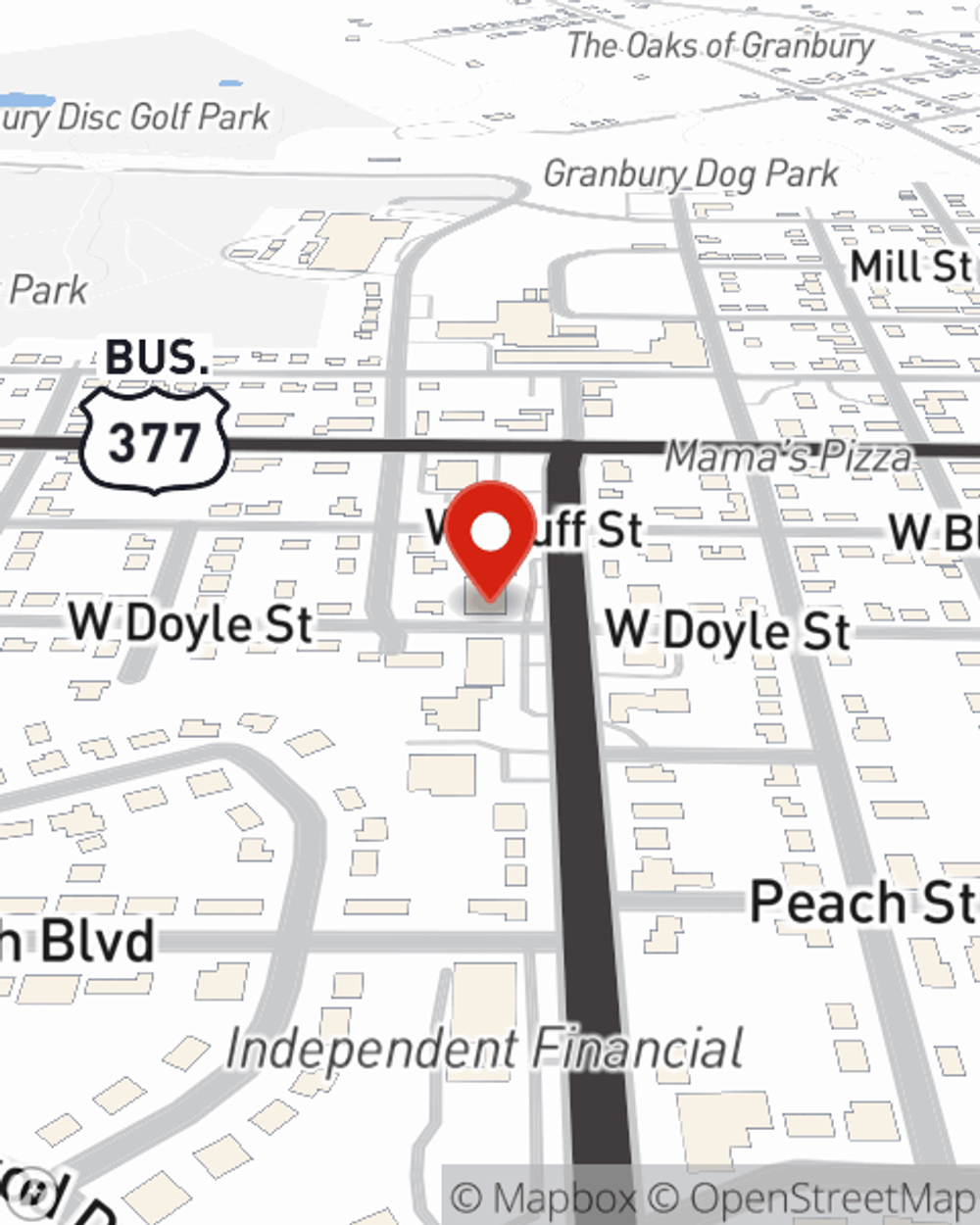

As a small business owner as well, agent Jace Foreman understands that there is a lot on your plate. Reach out to Jace Foreman today to review your options.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Jace Foreman

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.